Banking's Privacy Crisis: Exploring Crypto's Role in Protecting Personal Financial Data

As banks start using your personal spending data for targeted advertising, it's time to question the state of financial privacy and explore potential solutions in the world of cryptocurrency.

Your bank knows you intimately. It knows when you stop at Starbucks on a Friday morning and when you cash out at the bar that Friday night. It knows how much money you make, when and where you like to shop, and what politicians you contribute to.

And now these companies are going to use this data, your personal spending data, to sell advertising.

A new unit, Chase Media Solutions, will help brands target the bank’s customers based on their spending history.

Last month the Financial Times reported that JP Morgan Chase will begin to use its customers’ banking data to sell advertising. As JP Morgan is the biggest bank in the world, it’s only a matter of time until every bank begins to do this.

Currently, the bank will use this data to advertise directly to its customers through its Chase Offers program. If successful, who knows where this program will go?

Where has our privacy gone?

As we’ve slowly turned into a cashless society, large financial institutions have become the overseers of all our financial transactions. These companies have access to extremely personal data and the ability to do with it what they want.

There are no privacy laws or regulations in place preventing them from storing and accessing customer data. Instead, they have free rein to leverage it however they see fit. You may be able to opt out of an advertising plan, but who knows what else they're doing with your data behind the scenes?

Can crypto solve this?

Everyone should have a right to privacy. This right should extend to your personal financial history as well. In today’s banking system, we don’t have these rights, and I doubt we’ll get them anytime soon.

The only way to solve this problem is to look outside the banking system. This is where crypto comes in.

Privacy in crypto

Privacy coins like Monero exist today. They aren’t widely used and don’t appear to be trusted by most crypto users. It’s been some time since I looked into them. The last time I did, they were more centralized than Solana. (I kid. Solana is actively working to become more decentralized).

I don’t think Monero is the answer to our privacy issue, and I’m not sure what is.

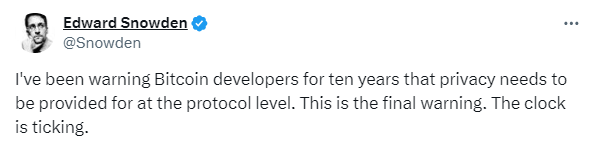

With the recent government actions against Wasabi Wallet, it appears it may be too late for Bitcoin.

Zero Knowledge Proofs could be the answer. This technology is still being developed and could be leveraged across many different blockchains, including Ethereum and all its L2s.

I’m not sure what the long-term answer is. It could be privacy coins or another solution. We’ll have to wait and see.

Conclusion

Our financial privacy is at risk in today's digital world. When we use credit cards and digital payments, our personal spending information is collected and stored by big banks. Now, these banks are starting to use this data to sell targeted ads, as seen with JP Morgan Chase's recent announcement.

The problem is that there aren't strong privacy laws to protect our financial data from being misused. While cryptocurrencies could potentially solve this issue, the current options like privacy coins (e.g., Monero) have their limitations. Recent government actions against privacy tools in the crypto space also show that there are challenges to overcome.

New technologies like Zero Knowledge Proofs are being developed and could help protect financial privacy across different cryptocurrencies. However, it's still unclear what the best long-term solution will be.

As we move forward in this new era of digital finance, we must make protecting our personal financial data a top priority. We need to work together to find ways to safeguard our financial privacy, whether it's through developing better privacy solutions in the crypto world or pushing for stronger privacy laws in the traditional banking system. Our financial freedom in the future depends on it.